Development Underwriting & Risk Platform for C&I Solar

Derisk ITC-sensitive projects with institutional-grade screening, lender-aligned P90 modeling, and tax equity–aware development economics.

Sound Familiar?

Every C&I developer knows these problems. They cost you deals, credibility, and margin.

Excel Model Hell

Fragile spreadsheets that break when you sneeze. Consultant-built models costing $10k–$50k that nobody trusts.

IC Back-and-Forth

Weeks of rework because the IC wants "one more sensitivity." Deals dying in committee review.

Mispriced Interconnection

Discovering $500k in network upgrades after you've committed capital. Queue position surprises.

Poor TE Conversations

Tax equity partners questioning your model logic. Losing credibility in flip year debates.

Bad Deals Too Late

$50k–$200k sunk into development before realizing economics don't work. Should have killed it in month one.

No Apples-to-Apples

Every project modeled differently. Can't compare deals across your pipeline. IPPs questioning your consistency.

Replace Excel. Impress Your IC.

Everything you need for IC-ready underwriting in one platform—not five spreadsheets.

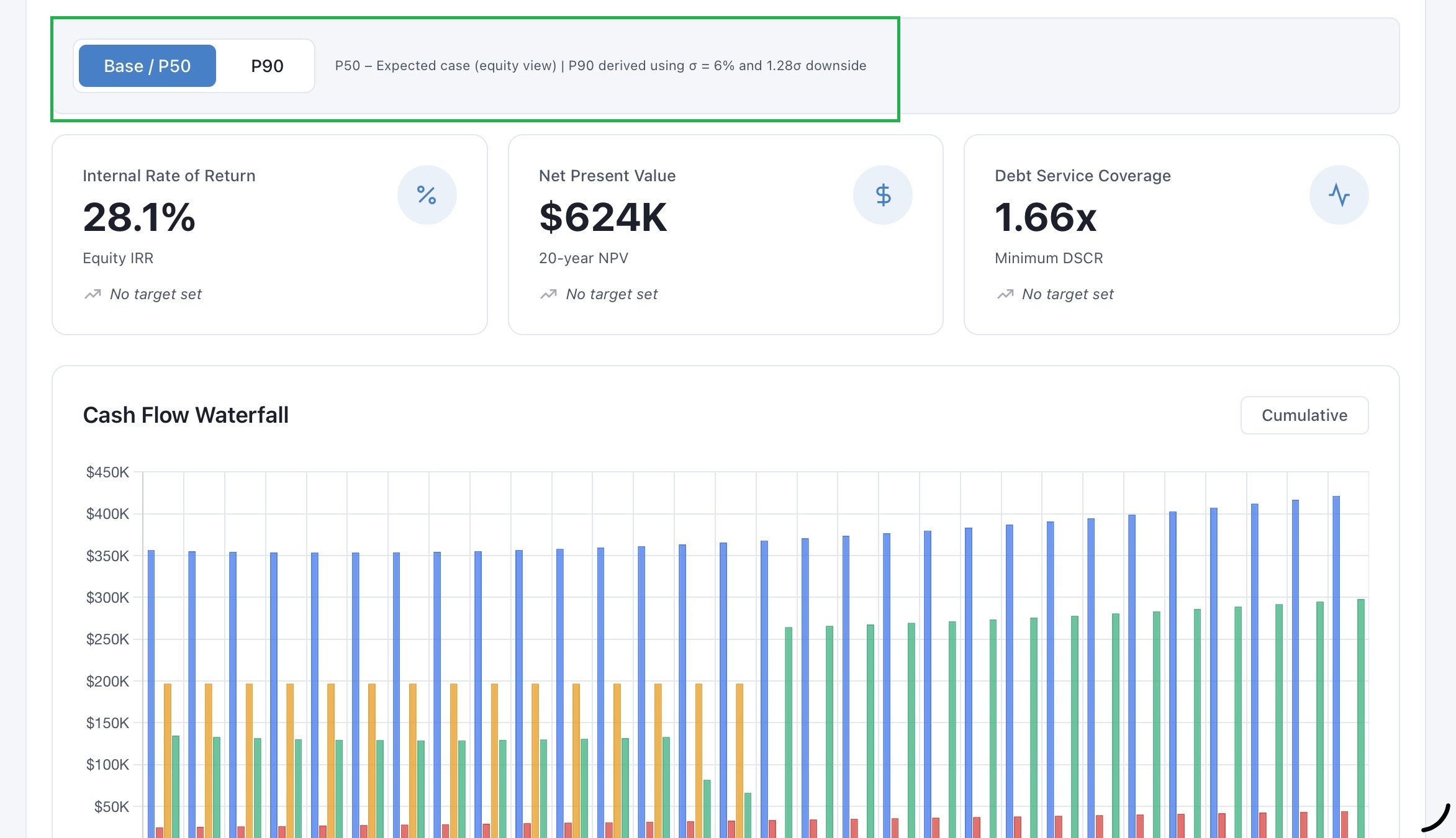

Tax Equity–Aware Economics

Model complex capital structures that satisfy institutional investors. Partnership flip, sale-leaseback, inverted lease—all with proper ITC allocation logic.

- 30+ year cashflows with degradation curves and escalation

- P50/P90 scenarios for lender-aligned risk modeling

- Flip year determination with TE yield optimization

- DSCR covenant tracking with minimum thresholds

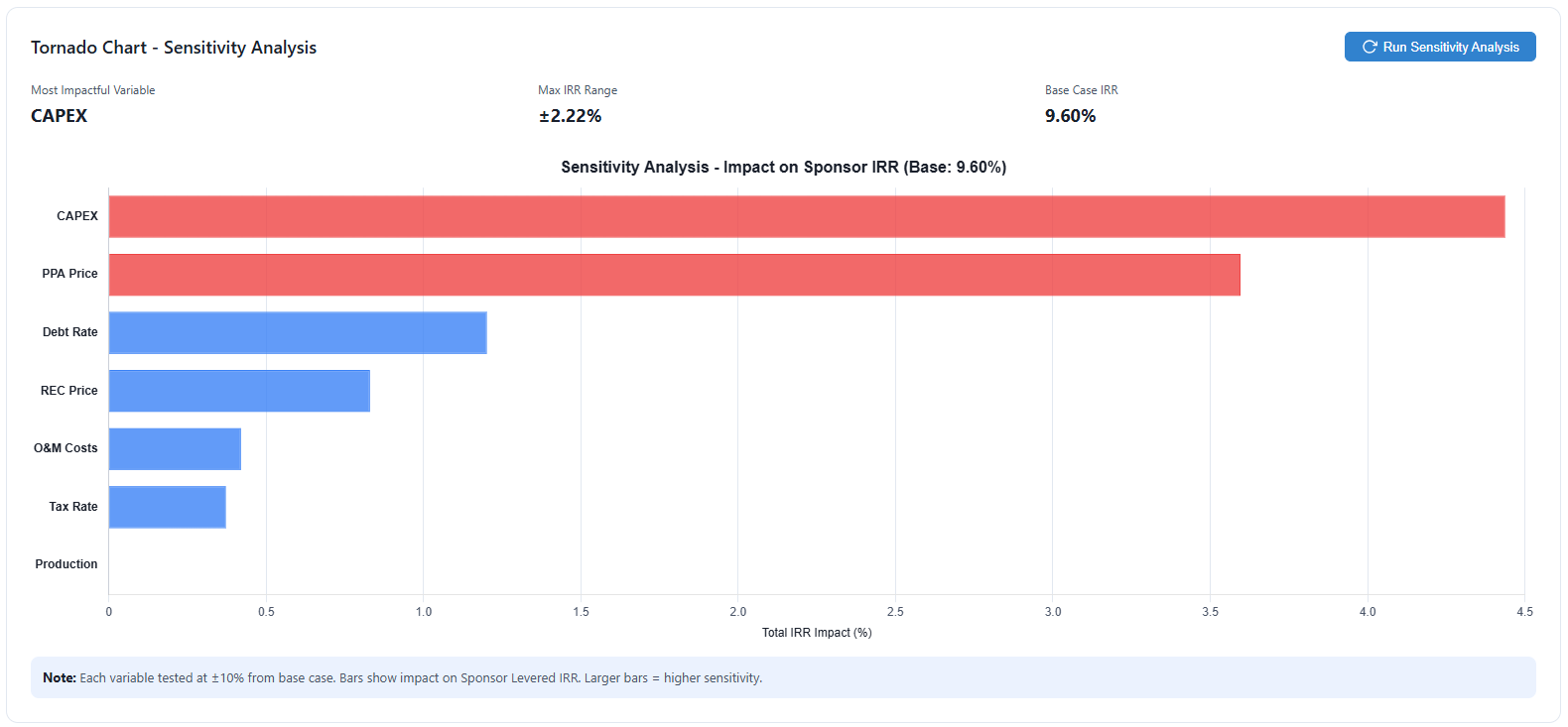

Know What Moves the Needle

Instant tornado charts ranking 15+ variables by IRR impact. Walk into IC knowing exactly which assumptions matter.

- One-click analysis—no more manual scenario tables

- ±10% sensitivity on every key variable

- Export to PDF for IC presentations

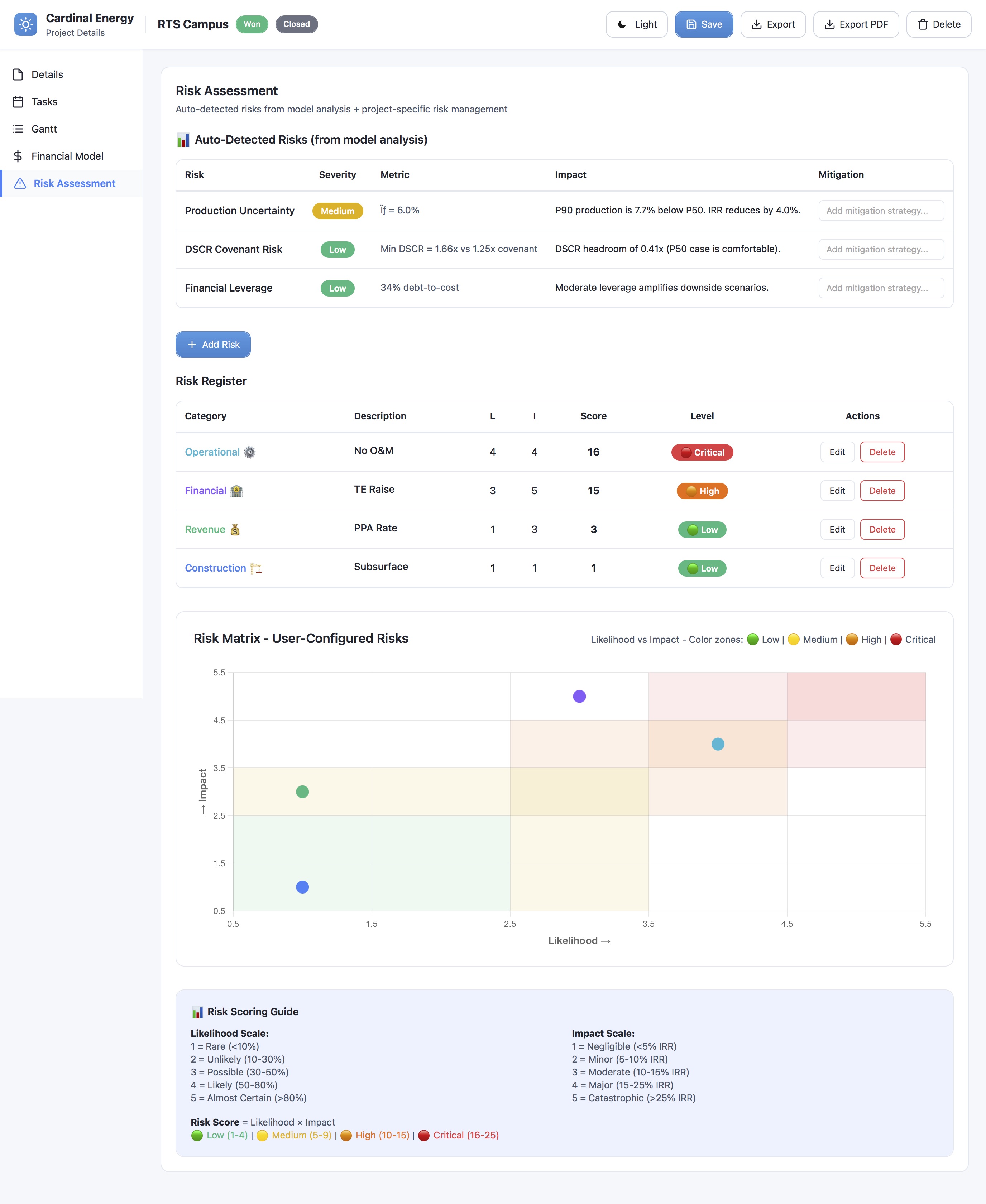

Kill Bad Deals Earlier

Auto-detected risks from model analysis plus your own custom risk register. Visual risk matrix shows exactly where your project stands.

- Auto-calculated risks from financial model (DSCR, production variance)

- 6 risk categories: Construction, Revenue, Regulatory, Financial, Operational, Market

- Risk matrix visualization with likelihood × impact scoring

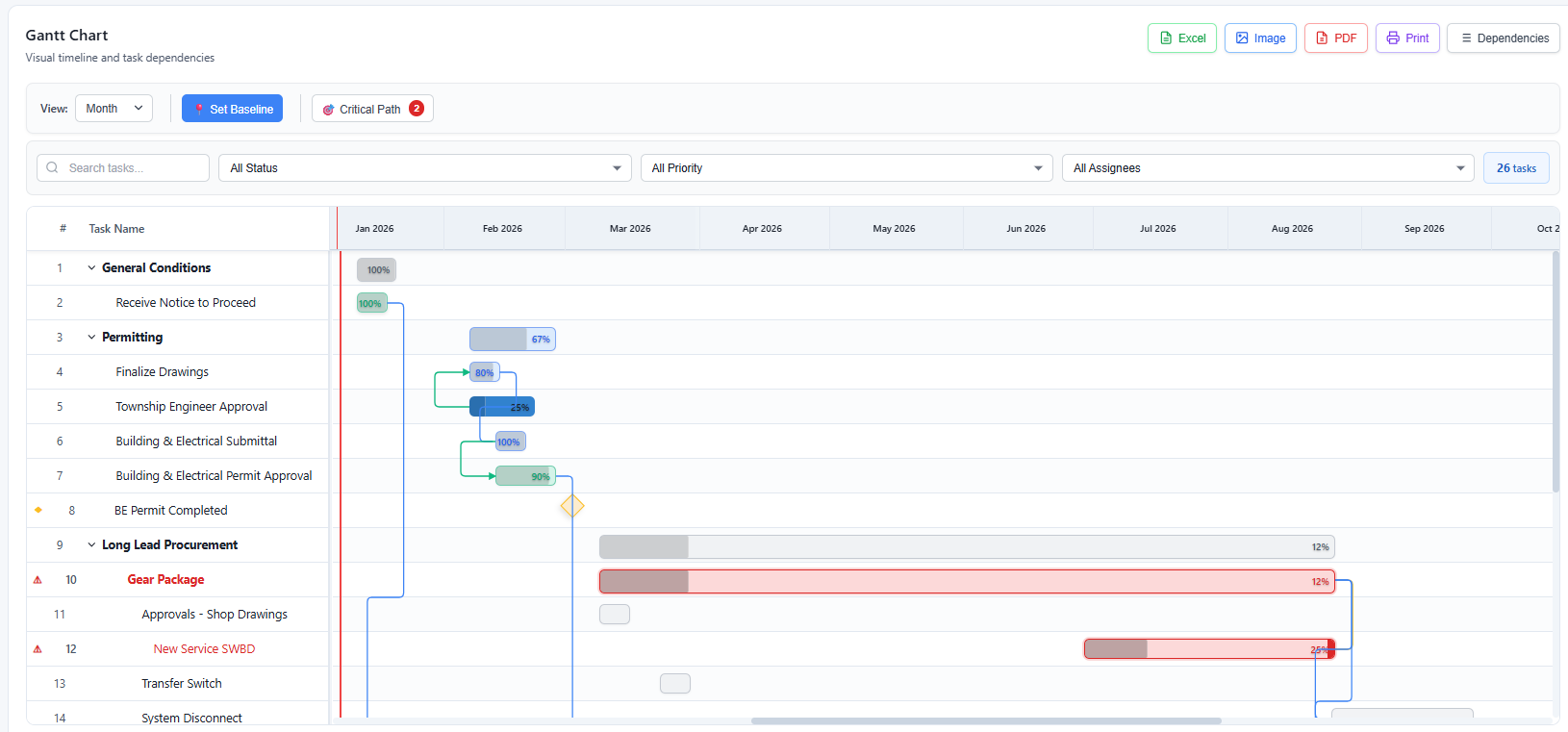

Track Critical Path

Interactive Gantt chart with dependency visualization. Know exactly what's blocking your COD—and who owns it.

- Drag-and-drop scheduling with auto-dependency updates

- Critical path highlighting—see schedule-critical tasks

- Baseline comparison to track schedule slippage

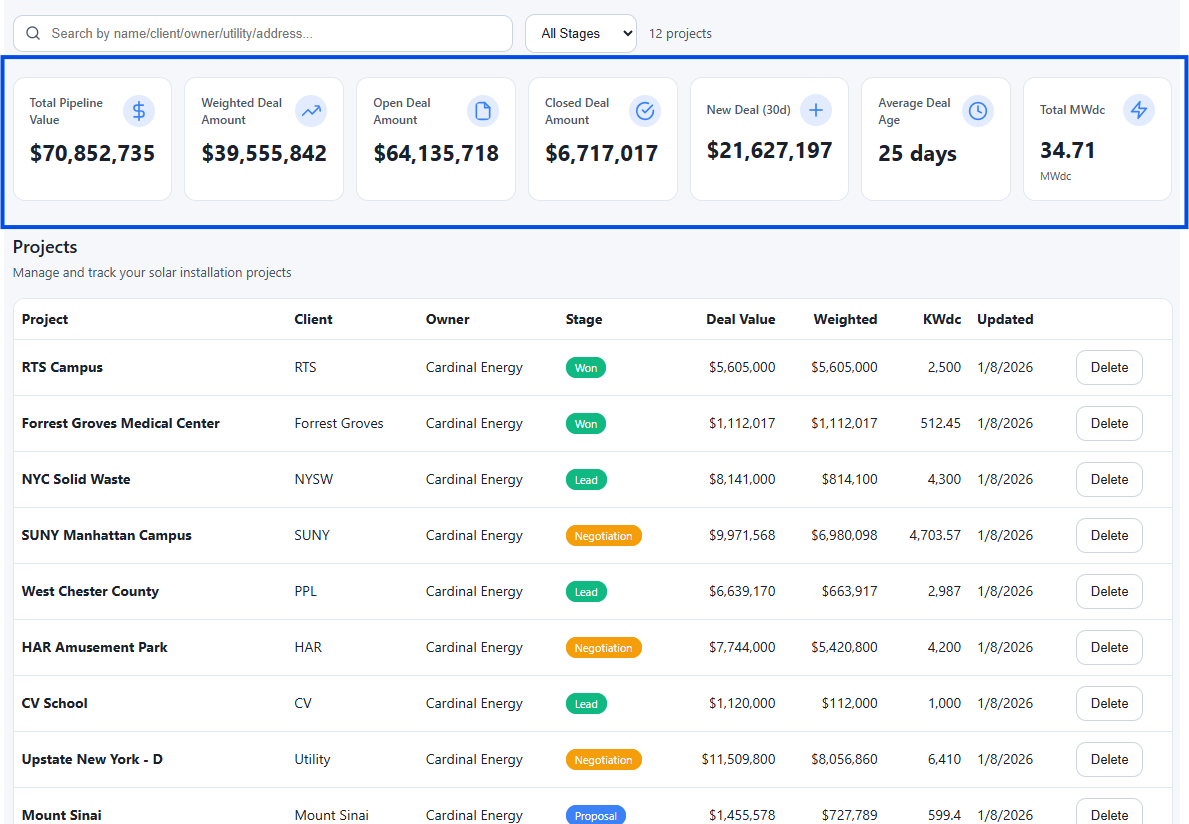

Apples-to-Apples Pipeline

Compare deals consistently across your portfolio. Total pipeline value, weighted deal amount, MW under management—all in one view.

- Portfolio KPIs that roll up from every project

- Stage tracking—Lead, Proposal, Negotiation, Won

- Consistent underwriting so IPPs trust your numbers

Consistent Investor Ready Reporting

Professional reports that satisfy LPs, lenders, and investment committees—generated in seconds, not days.

Complete Report Package

One-click export of institutional-quality documentation

Scenario Comparison

Side-by-side P50 and P90 analysis showing lender-aligned downside scenarios

Financial Dashboards

Visual summaries of project economics, returns, and key metrics

Payback Analysis

- • Simple Payback

- • Discounted Payback (NPV-Adjusted)

Capital Structure Details

Complete breakdown of debt, equity, and TE contributions with key ratios

Operating Performance Metrics

Key operating indicators, capacity factors, and production analysis

Tax Equity Structure

- • Structure Details

- • Structure-specific Information

- • TE/Sponsor/Debt Cash Flow Breakdown

30-Year Cash Flows

Separate tables for P50 and P90 scenarios with full lifecycle projections

Get a Free Analysis of Your Project

Submit your project details and our team will provide a comprehensive underwriting analysis—including risk assessment, return metrics, and optimization recommendations.

No commitment required • Response within 48 hours

Built for Solar Finance Professionals

If you control capital, deal flow, or go/no-go decisions—this is for you.

C&I / DG Developers

Screen hundreds of sites fast. Get IC-ready underwriting without consultant models. Kill bad deals before you waste $50k on development.

IPPs & Investment Platforms

Compare deals apples-to-apples. Standardize assumptions across developers. Review portfolios with consistent downside analysis.

Developer-Operators

Optimize asset-level IRR. Tune capital stacks. Compare TE structures. Get long-term cash flow visibility for assets you'll own for decades.

Tax Equity Teams

Standardized, transparent assumptions. P50/P90 logic you trust. Use as a review tool or shared platform with developers.

EPCs with Dev Arms

Qualify leads before committing resources. Speak developer finance credibly. Support clients with financing-ready outputs.

Not For

Residential solar, one-off developers, sales-only orgs, or homegrown Excel users with no financing ambitions.

Software + Strategic Support

Beyond the platform—expert guidance to maximize your development economics and close better deals.

Development Advisory

Strategic guidance from experienced solar finance professionals

Ready to Kill Bad Deals Earlier?

Stop losing margin to fragile Excel models. Get IC-ready underwriting that institutional investors actually trust.

Starting at $3,000/year per seat • Team and enterprise plans available